#buildingPLR Looking for Store #2 (+ adding more growth)

Doing good work = open doors

You, my readers, get to know this before it goes public does (lucky you).

My investors backing Irvine Spectrum have been pleased with the store, brand, and team…and wanted to expand the relationship.

Just this week, they’ve invested in a 5-unit deal to open stores in Northern California, and want my team to run them all.

WOOHOO!

The cities we’ve secured are:

San Jose

Cupertino

Stanford / Menlo Park

Mountain View

Santa Clara

I’M PSYCHED.

This area is populated; high-income; prone to eat out (the fast casual and full service restaurants generally do well, here); and has a high ratio of Asians, familiar with the brand - or, at the very least, familiar with the cuisine.

We’re sorting through logistics i.e. entity formation, real estate strategy, capital needed, travel, etc. but I’m excited to keep this going.

And being asked to steward more of their investments is the biggest compliment I can receive.

My old boss Dan Rowe’s advice “If you take good care of your investors, you’ll never have to ask for money again,” is playing out nicely.

This puts me in control of 11 stores in development (I have one group of investors funding Los Angeles stores, and this other group investing in Irvine Spectrum and Northern California).

What about supply chain?

The above news will make this post I made on LinkedIn relevant (click on the picture).

After I posted this, a few franchisees of other brands reached out to me, privately - telling me their COGS are higher - sometimes DOUBLE - what stores near their brand’s headquarters are; and that makes it hard to scale.

Franchisors can’t just focus on the business model, and say that third-party vendor prices are “out of my control.”

I’m comforted to know that - with Pepper Lunch - regardless of whatever new market I enter, or that of the franchisees I serve - they have the best chance possible for profitability.

Last Wednesday, Dana Hathaitham - our head of construction and design - and I met up at what is 75% going to be Store #2 down here in SoCal.

Here’s a picture of Dana going up the ladder to the roof in high heels.

She’s crazy.

After touring the store, here are a few insights we took away:

The space is big enough. One of the hampers on our sales at Irvine Spectrum is that the layout doesn’t give us the max amount of seats.

1,600sf + 400sf patio = 2,000sf total (which is Irvine’s size) would’ve been ideal…IF we got to build this store from scratch.

The kitchen would’ve been half its current size and it’d be a perfect rectangle.

But we took over an old restaurant infrastructure whose kitchen was way too big and had weird walls that blocked full utilization.

While our build-out costs were about $300K (minus rent and wages caused by opening delays) - which is sexy, when you consider average costs being $700K - we inherited inefficiencies and slow-downs to our sales.

It’s the trade-off.

I still believe we’re going to hit $3M out of Irvine Spectrum, because the real estate is superior and the team and concept can pump it.

But space matters with this concept, and unlike other fast casuals that can do and prefer off-prem (off-premise sales - take out, delivery, and catering) - we make more money when customers dine-in than when they do take-out.

This potential store is 2,505sf, with a little bit of patio (maybe 200sf?).

This is also a second-generation store. I expect there to be minimal remodeling needed. The layout is almost perfect.

I’m guessing this store will be a $400K build-out - the kitchen will need little-to-no changes; but we have a big dining area - which will require a lot of millwork (banquettes, tables, chairs, soffits, lighting, interior signage).

The co-tenancy is strong. There are lots of restaurants - fast casual and full-service - that are doing above-average, in this center….

Except the tenant occupying the space we want.

I don’t believe it’s a space issue. The current tenant itself is an old, tired brand that’s struggled to grow and be relevant for as long as I can remember.

I know the owners/franchisors of three restaurants in the center, and one across the street - so I reached out to them and asked:

?? How well their stores did,

?? Whether they’d recommend I enter,

?? What the landlord is like, and

?? If they had words of caution or advice in general.

One of them is the franchisor a 40-unit tea chain (an ideal co-tenant of ours), and their store there does above-average there.

The other is a 100+ unit franchisor, whose unit there does above-average as well.

The third tenant is a franchisee of a full-service restaurant there. He mentioned that our space is better-located; the center is busy; and if we want to insure success, we’d be smart to market aggressively there.

The fourth operator - who has a store across the street - is a franchisee of another brand I admire. He mentioned that - whereas his brand’s AUV (average unit sales) was $5M - his store did $6M, here.

Promising.

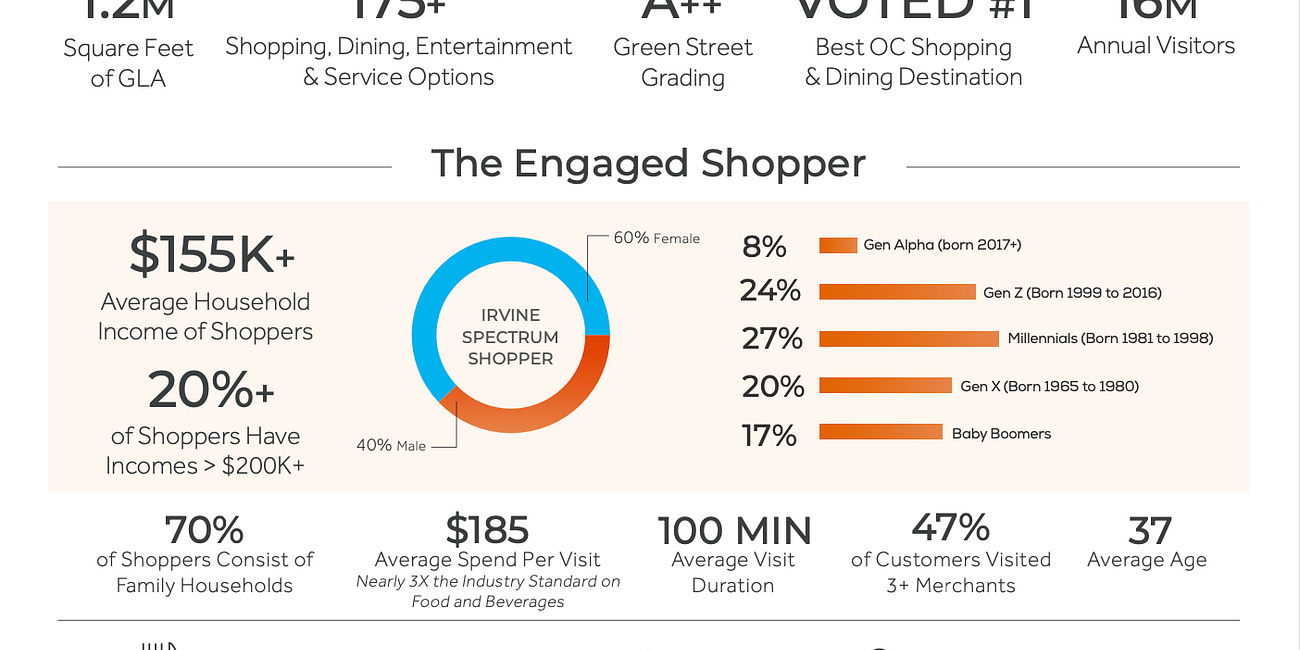

The center reminds me of Irvine Spectrum. I talk about how the characteristics of Irvine Spectrum in a previous issue, here":

But I love that it’s an outdoor mall - which means that people will come here to entertain, and fuel the Summer and Winter shopping season.

There are also business buildings nearby - which give us a stable day time lunch.

There are multiple streams of customers. Where Irvine Spectrum has mainly white-collar day time workers - this location has a good mix of white-collar, blue-collar, AND hospital traffic.

I like the diversification; and we’re still competitively priced against other fast casuals, and a better speed and value than the full-service counter-parts, here.

If you wanna know how I truly feel…Irvine Spectrum is such a killer, that I worry about not hitting the same sales.

But I need to remember a few things:

High sales is one factor; profitability is another. The hourly wages in this market are less; and the rent here is $5K/month less - with no percentage rent.

That’s already a $10K/month margin of error, or profitability back to the bottom-line.

I’m building a portfolio company. Just like my chain of 9 stores (which were valuable as a group and eventually was acquired in a group), some stores will be higher sales/profit, and some will be lower.

This is why you need to be a multiunit operator - to increase the value of your enterprise and diversify.

All of the data supports this store.

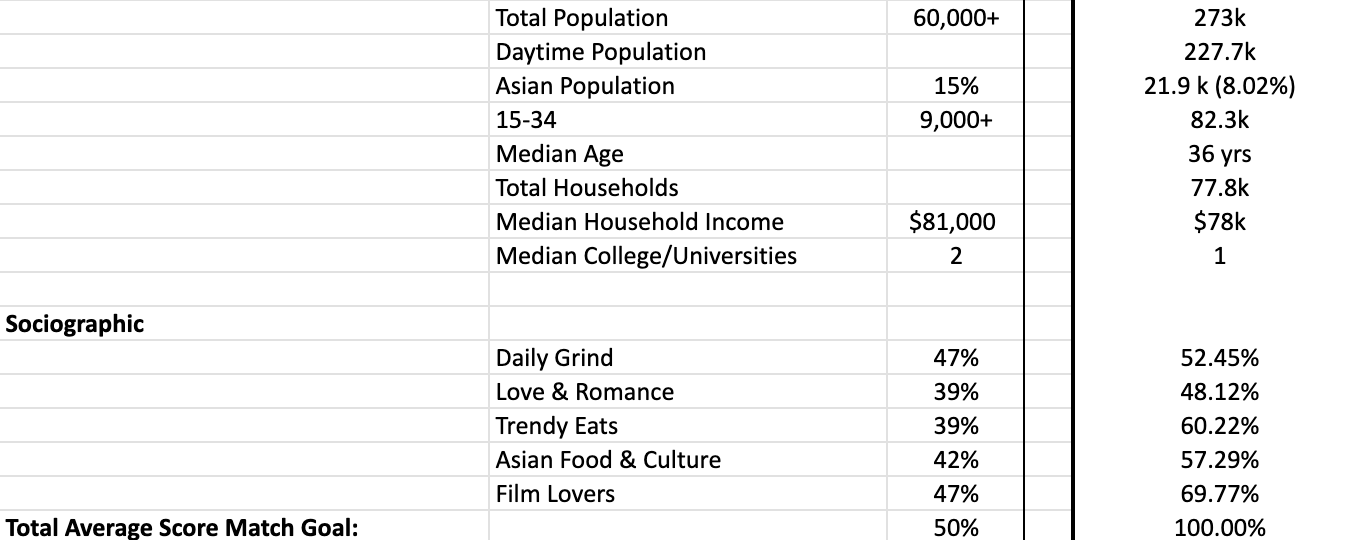

In addition to franchisor knowledge; my local knowledge; intel from our broker (shout-out to Blake Kaplan and Drew Olson at JLL who found this off-market opportunity); Dana pulled data from SiteZeus:

The first column of numbers is the benchmark; and the second column shows how this site stacks up against those figures.

As you can see:

The total population within a 3-mile radius is almost FIVE TIMES the benchmark.

Day time population within a 3-mile radius is bananas. When I was running The Halal Guys, the benchmark was 30K. By that standard, we’re almost EIGHT TIMES the minimum needed).

The population between the ages of 15-34 is NINE TIMES what’s needed.

My main concerns were the lower median household incomes and less Asian density, as a percentage.

But:

50% of our customers are under the age of 30; and

Even though the percentage of Asians are low, the actual count of Asians over TWO TIMES the benchmark.

That gives me comfort.

The sociographic numbers are also running on all cylinders, too.

But it’s just the data story.

Numbers are only one part of the picture.

There’s also taste, experience, intuition, and taking a risk on the gap on unknowns that can never be filled on this side of taking action.

So…we submitted an LOI. Fingers are crossed!

I’m curious…where do you think Store #2 will be?